31+ Colorado Take Home Pay Calculator

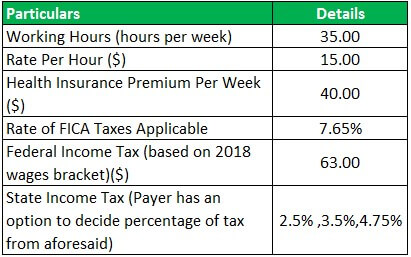

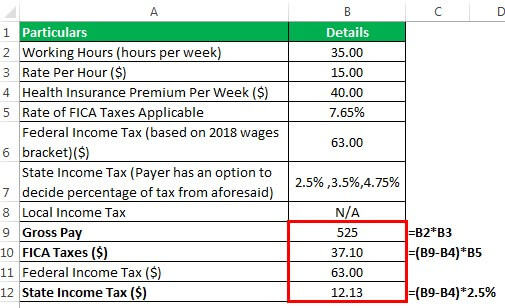

Use the hourly paycheck calculator to see your take home pay after taxes in Colorado. For example if an employee earns 1500 per week the individuals.

Paycheck Calculator Take Home Pay Calculator

Salary Paycheck Calculator Colorado Paycheck Calculator Use ADPs Colorado Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

. It can also be used to help fill. This income tax calculator can help estimate your average. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Colorado. Simply enter their federal and state W-4. If you make 55000 a year living in the region of Colorado USA you will be taxed 11397.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. That means that your net pay will be 43604 per year or 3634 per month. Tax rates The calculators on this website are provided by Symmetry Software and are designed to.

Beside the federal income tax the residents of Colorado only need to pay the state-level income tax which is a flat rate of 455. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Colorado. Colorado Income Tax Calculator 2021 If you make 70000 a year living in the region of Colorado USA you will be taxed 11001.

Open an Account Earn 14x the National Average. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado. The state income tax rate in Colorado is under 5 while federal income tax rates range from 10 to 37 depending on your income.

How much do you make after taxes in. The Colorado Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Colorado. Easy 247 Online Access.

Your average tax rate is 1198 and your marginal. Well do the math for youall you need to do is.

The Measure Of A Plan

Interface Vol 30 No 4 Winter 2021 By The Electrochemical Society Issuu

7263 Cedar Brush Court Colorado Springs Co 80908 Mls 8497034 Copikes

![]()

The Measure Of A Plan

Colorado Salary Calculator 2023 Icalculator

Partial Benefits National Employment Law Project

Take Home Pay Definition Example How To Calculate

L6hmrvkbxrvwjm

Chapter 11 The Chi Square Distribution Arkansas State University

Take Home Pay Calculator

Federal Register Medicare Program Fy 2016 Hospice Wage Index And Payment Rate Update And Hospice Quality Reporting Requirements

Medical Coding Salary Medical Billing And Coding Salary Aapc

Top 5 Best Salary Calculators 2017 Ranking Top Net Gross Salary Calculators Advisoryhq

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

Brush Meadows Apartments 1225 Lake Elmo Dr Billings Mt Rentcafe

Free Paycheck Calculator Hourly Salary Usa Dremployee

11711 Bruceville Road Elk Grove Ca 95757 Compass

Colorado Income Tax Calculator Smartasset